Sysparency optimizes and documents core banking system of a leading global financial institution

The financial institution faced the complex task of optimizing business processes, replacing obsolete legacy solutions, and meeting regulatory requirements. A previous core financial application replacement project failed, putting undue strain on the budget, and another failure had to be avoided at all costs. In addition, regulatory minimum documentation requirements had to be met.

Sysparency was contracted to provide comprehensive, automated software documentation for the mainframe-based core financial application. This was to be implemented with minimal effort and in a short period of time, compared to the thousands of person-days estimated internally. It was essential that this documentation serve as a basis for the completeness of the new specification, thus minimizing the risk of another failure.

Approach and solution approach:

Sysparency’s innovative, AI-based solutions were used to perform multi-layered analyses, evaluations and documentation (reverse engineering). Extensive workshops and meetings contributed to the development and integration of technical and business inputs.

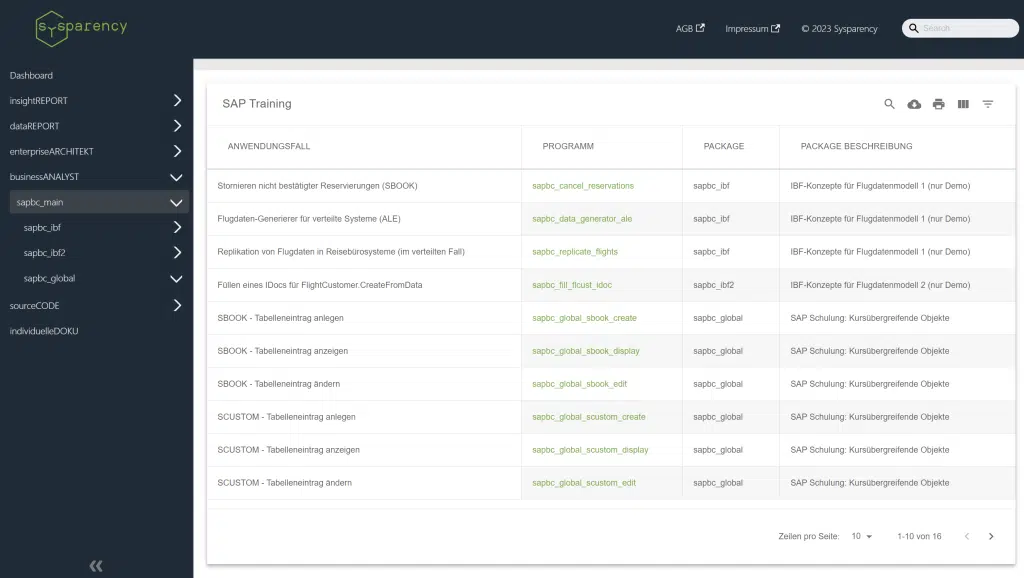

Sysparency used qualified tools, customized and extended for each task, to create a model representation of the software and generate the different parts of the documentation. The process included:

- Inventory: collection of existing documentation and incorporation into the system.

- Measurement: Measurement of the entire program code of the system based on various KPIs and metrics.

- Post-documentation: Creation of functional, technical and overall documentation – from automatically generated user interfaces, interfaces, functional workflows to data access and batch processing.

The resulting documentation was divided into three sections:

- Technical documentation: Creation based on requirements analysis according to IREB© standard and workshop results.

- Technical documentation: Automated and semi-automated documentation, identification of business rules, data flows and business rules.

- Interface documentation: Creation of call trees and identification of internal and external interfaces.

Results:

Sysparency was able to deliver the documentation within a fraction of the effort and time, realizing a potential savings of € 100 million at a project cost of € 2.5 million over 24 months. The documentation created was successfully accepted by management, the specialist department, IT and the compliance department and now forms the basis for the overall documentation of the system.

Special added value through AI-based reverse engineering with Sysparency:

- Agile and Efficient Business Processes: The use of state-of-the-art AI technology enabled a significant increase in efficiency and agility in business processes.

- Improved documentation: Transparency and compliance have been increased through improved and automated documentation of SAP Z programs.

- Meeting compliance guidelines and visualizing all communication channels and branches.

- Reusable repository for analysis results.

- Cost reduction: by empowering the internal team and reducing dependence on external service providers.

Interested or have further questions?

Arrange a no-obligation initial consultation with our SYSPARENCY experts.

We will introduce you to our products and answer all your questions in a straightforward online meeting.